In a lifelong characterized by brassy takeovers, Patrick Drahi’s offered for Sotheby’s positions as maybe the most amazing of all.

The French-Israeli big shot has since quite a while ago pursued his very own way in business, tapping the market for garbage appraised obligation to help construct the second-greatest telecom organization in France. Furthermore, Drahi avoided the world class bastions of Paris by posting Altice Europe NV in Amsterdam and settling in the snow capped town of Zermatt, Switzerland.

At the point when this quintessential untouchable declared on June 17 that he would spend $2.7 billion to buy Sotheby’s, the notable 275-year-old sales management firm, a heap of inquiries pursued. Is it accurate to say that he is looking for a trophy advantage for sit on his rack, or will he shake up a firm that had seen its offer value tumble by 40% in a year? Is it insightful to heap more obligation onto Sotheby’s? Furthermore, exactly who is Drahi in any case?

One thing is now clear: the offer opens another section for a business visionary who transformed a $9,000 understudy advance into a $8.5 billion fortune, making him the 6th most extravagant individual in France, as per the Bloomberg Billionaires Index.

It’s additionally conceivable that different bidders could challenge Drahi’s offer, which was set at a 61% premium to Sotheby’s end offer cost on June 14. On Friday, the New York Post revealed that other potential purchasers might circle, which pushed the association’s stock over the offering cost. On the off chance that Sotheby’s acknowledged an adversary offer, it would need to pay Drahi an end expense of nearly $111 million, as indicated by an administrative recording.

Sotheby’s may get different ideas after Drahi

In any occasion, Drahi, 55, said small regarding his explanation behind the procurement in Monday’s announcement, spare that he’s for quite some time been a customer and admirer of Sotheby’s. He declined to be met for this article.

Arthur Dreyfuss, a representative for Drahi, said the buy “is a long haul family interest in an industry he is energetic about.”

Craftsmanship Lover?

The offer annoyed the craftsmanship world and sent sellers scrambling for data about the man, who wasn’t broadly known as a genuine gatherer. Specialists saturated with the back and forth movement of the market were unable to distinguish what artistic creations he’s purchased, despite the fact that an individual with learning of Drahi’s accumulation said he claims pieces by Picasso, Matisse and Chagall, just as works by nineteenth century French experts Gericault and Delacroix.

Conceived in Casablanca, Drahi moved to southern France from Morocco when he was 15. He went to his first craftsmanship sell off around at that point, however at that age he could just watch. That changed by 2007, the year he cobbled together territorial link administrators into another organization called Numericable. Drahi likes to take an hour or two while on work excursions and visit nearby displays and church buildings, as he did on an ongoing makeshift route to the Louver’s station in the northern French city of Lens, said the individual, who asked not to be distinguished.

‘Moment Fame’

Taking Sotheby’s private following 31 years on the New York Stock Exchange will unquestionably make Drahi a persuasive figure in the market for artistic work and collectibles, which added up to $67.4 billion a year ago, as per a yearly report distributed by UBS Group AG and Art Basel.

He will remain inverse Francois Pinault, the French very rich person who established an extravagance products domain that envelops names like Gucci and St. Laurent and controls Christie’s, Sotheby’s notable opponent. In procuring Sotheby’s, Drahi would reflect A. Alfred Taubman, the late American shopping center engineer, who gathered up Sotheby’s in 1983 and took it private.

“Individuals didn’t realize Alfred amazingly well at the time, yet it gave him moment notoriety in the workmanship and social world,” says Warren Weitman, a previous Sotheby’s official and fellow benefactor of Art Market Advisors in New York.

Owning Sotheby’s would give Drahi a first see pieces going onto the market, in addition to a prepared outlet for selling his own works, industry specialists said. Taubman purchased molds by Alberto Giacometti and depictions by Georgia O’Keeffe and Picasso, among others, at sell-offs, and when of his demise in 2015 he’d amassed a gathering once esteemed at $500 million. (The agent was sentenced for value fixing in an industry-shaking preliminary in 2001 and served just about 10 months in jail).

‘Desired Works’

As far as concerns him, Pinault is among the world’s top gatherers with works from for all intents and purposes each real current, after war and contemporary craftsman. His $1.2 billion accumulation is vast to the point that he displays pieces in two palazzos in Venice and is building a historical center in Paris.

“I am certain entrance to the most pined for works before any other individual is an extra advantage to this obtaining in the back of Drahi’s psyche, as probably been the situation with a fanatical authority like Mr. Pinault,” says Wendy Goldsmith, author of Goldsmith Art Advisory, a London-based counseling firm.

However Drahi will be on the snare should the funds of his new obtaining go sideways. Struck by abrupt swings in purchasing action, the craftsmanship world can be an unpredictable and uncertain spot. In 2016, for example, deals in China slid forcefully and added to a 16% drop in income at Sotheby’s, says Alex Maroccia, a value investigator with Berenberg Capital Markets in London.

Moody’s Review

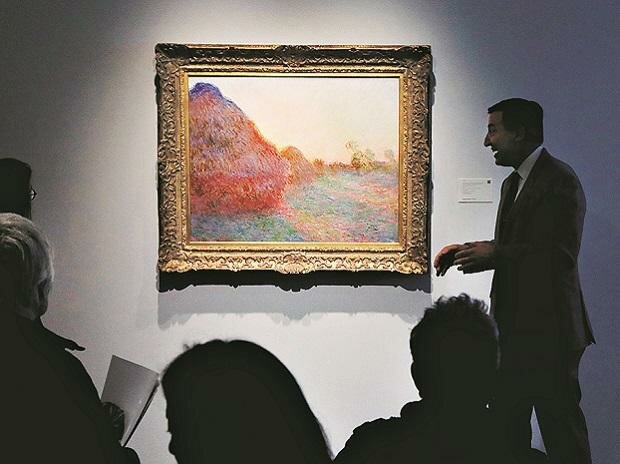

Regardless of the cosmic entireties paid for top works – Claude Monet’s ethereal rendering of bundles called “Meules” got $110.7 million at Sotheby’s in May – the organization has attempted to post steady development. In 2018, the firm, which profits basically by deals commissions, earned $108.6 million in overall gain on $1 billion in income, a 8.5% slide from 2017. In the main quarter of this current year, it lost $7 million.

On Tuesday, Moody’s said Sotheby’s balanced obligation was multiple times its income before intrigue, duty, deterioration and amortization – an abnormal state for an extravagance products concern. Moody’s, which as of now positions Sotheby’s obligation at beneath speculation grade, put the firm on survey for a FICO assessment downsize. Drahi might anticipate financing a major lump of his arrangement by selling more garbage appraised obligation.

Cutting edge Shakeup?

Drahi, an alum of France’s world class building school, Ecole Polytechnique, might be enticed to carry his innovative skill to endure. Sotheby’s cell phone application as of now allows clients to offer nonstop in online sell-offs of fine books and original copies or nineteenth century European depictions. A year ago, the firm purchased a New York startup called Thread Genius that utilizes “picture acknowledgment” programming to employ clients with workmanship they may like dependent on past buys. It’s broadly acknowledged that the workmanship market is long past due for the kind of computerized upheaval that changed different ventures.

Be that as it may, if Drahi is mulling over utilizing computerized computerization to cut compensations, Sotheby’s greatest cost, he might need to reconsider, specialists said. The closeout business is as yet determined by the connections between deals delegates who comprehend what workmanship purchasers need and well-obeyed clients who require hand-holding and trust.

“Patrick Drahi may have some squirm space to cut expenses, yet not enormous squirm room,” says Franck Prazan, the proprietor of Applicat-Prazan display in Paris.

More than anything, the craftsmanship world is propping to perceive how Drahi, the newcomer, will square off against the veteran Pinault. Secured a savage competition, Christie’s and Sotheby’s control about 20% of the worldwide craftsmanship advertise, as indicated by the UBS report. Christie’s had $7 billion in deals a year ago, contrasted and $6.4 billion at Sotheby’s.

Whatever course Drahi takes’, will undoubtedly be show as Sotheby’s rejoins Christie’s in the hazy universe of private possession and another player makes his engraving on a peculiar industry.

“Every successful businessman who gets involved with the auction houses thinks that he can reinvent the wheel,” says Goldsmith, the art adviser. “Mr. Drahi may indeed find that he can’t reinvent the wheel, but he will have a lot of fun trying.”